- Joined

- Oct 22, 2007

- Messages

- 1,191

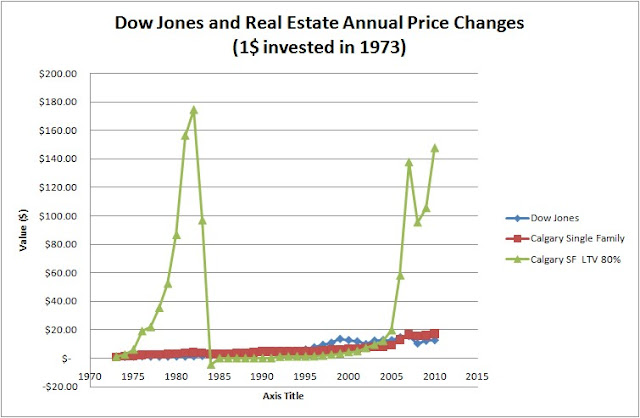

When investing in 1973 in non-leveraged real estate, a $1.00 investment would have appreciated to $17.23 in 2010 based on Calgary`s average single family house price. Was that same dollar invested in the stocks of the Dow Jones, it would have brought in $12.63. This does not include rental income or dividends. Of course there was volatility along the way. If the same comparison was done in 2005, your stocks would have been worth $12.60 and the real estate $9.39. As often pointed out at REIN, no investment does go up in a straight line. Also, Calgary real estate appreciates faster than many other parts of Canada. In Calgary, real estate appreciates at a compounded rate of about 8% while Canada`s average real estate compounds at 6% or so. Though the rate of appreciation is higher, cap rates in Calgary are lower than Canada`s average. A 1-2% difference in compounded appreciation may not seem significant, but over the same 37 year period, $1 invested in Canadian real estate would have appreciated to only $8.64.

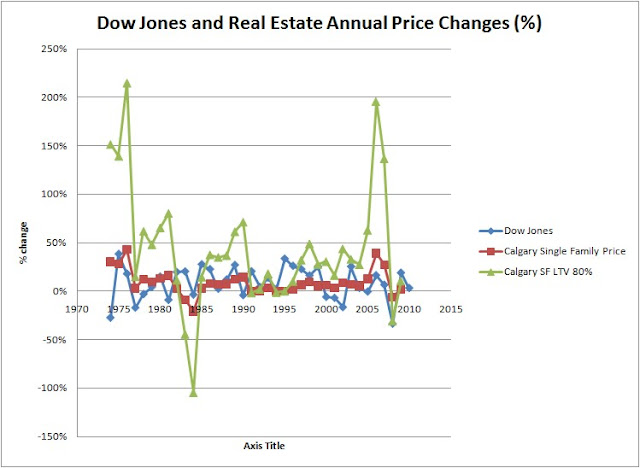

A lot of real estate investors feel real estate is less volatile than stock market investments. But when one compares year end stock market and real estate prices, this is not the case. Check out the graph in the figure below. Stocks trade on a daily basis and with price movements reported nearly instantaneous; while real estate prices are only reported on a monthly bases by local real estate boards. So it may seem that the stock market is more volatile, but as the graph shows, that is not necessarily the case on a year-over-year basis.

http://http://3.bp.blogspot.com/_nY...+estate+price+volatility+-+not+leveraged..jpg

Figure 1 - comparison of investment performance as the value invested of $1 in real estate compared with shares in the Dow Jones.

Price volatility is often referred to as risk, because if one is forced to sell in a down market, an investor is likely to sell at a loss. So the real issue is, whether one can hold on to an investment through good and bad times, until the investor chooses to sell the investment at a profit. That is, why buying at the right price but also selling at the right price are so important – both determine in the end how profitable the investment was.

So, if volatility constitutes risk because it may cause a forced sale at a market low, then when using leverage that risk is significantly increased, because a significant amount of the investor`s control regarding when to sell is handed over to the lender. The latter can be demanding repayment of the loan from the investor at any inappropriate time (a down market) and thus forces the investor to sell, possiblye at a loss – a loss that is magnified by the degree of leverage used. The higher the leverage is the higher potential is for loss. To get a better idea about how much higher the risk incurred is, have a look at the figure below, where the value of $1.00 invested without leverage in the real estate market or stock market is compared to a real estate investment levered at a LTV (loan to value ratio) of 80%.

I tried to copy in the figures several times - the Editor allowed figure 1 but I can`t get figures 2 and 3 posted. If you would like to see them, please, visit my blog (http://www.canadiandiversifiedinvestor.com/). Sorry for the inconvenience.

Figure 2- Investment performance of $1 invested in real estate or shares in the Dow Jones compared with an 80% LTV real estate investment. Note equity in the leveraged investment turned negative in 1985 and a new $1 investment was made after a 7 year period of bankruptcy and credit record repair.

The increased volatility of the leveraged investment is sufficiently extreme that the non-leveraged investments seem to increase smoothly. Also, the equity invested in the 80% LTV investment was wiped out in 1985. It was assumed in this simulation, that the investor went bankrupt and needed the subsequent 7 years to repair his/her credit record and to raise new equity ($1.00) before the investor was able to re-enter the real estate market to make a new 80% LTV investment.

In Figure 3, the same investment comparisons are shown but now in terms of year-over-year investment value change and expressed as a percentage of the amount invested in the year before.

I tried to copy in the figures several times - the Editor allowed figure 1 but I can`t get figures 2 and 3 posted. If you would like to see them, please, visit my blog (http://www.canadiandiversifiedinvestor.com/). Sorry for the inconvenience.

Figure 3- comparison of investment performance of $1 invested of $1 in real estate or shares in the Dow Jones with a 80% LTV real estate investment expressed in terms of the percentage of annual change.

My conclusion is that in terms of performance, non-leveraged stock market and real estate investments are comparable in terms of risk and return over the long term. However, their performance is not well correlated because Calgary real estate outperforms the Dow Jones over certain periods while at other times the Dow Jones out performs Calgary real estate. This supports the idea of investment diversification. The use of leverage adds significant real estate investment risk and increases the potential reward (returns). This risk is often mitigated by aiming for positive cash flow obtained from rental or other real estate activities. One must however ask oneself, based on the above result, whether long term stock market investments could not be enhanced in performance as well using leverage, where the risk related to volatility is offset by funds generated from dividend income and better liquidity.

A lot of real estate investors feel real estate is less volatile than stock market investments. But when one compares year end stock market and real estate prices, this is not the case. Check out the graph in the figure below. Stocks trade on a daily basis and with price movements reported nearly instantaneous; while real estate prices are only reported on a monthly bases by local real estate boards. So it may seem that the stock market is more volatile, but as the graph shows, that is not necessarily the case on a year-over-year basis.

http://http://3.bp.blogspot.com/_nY...+estate+price+volatility+-+not+leveraged..jpg

Figure 1 - comparison of investment performance as the value invested of $1 in real estate compared with shares in the Dow Jones.

Price volatility is often referred to as risk, because if one is forced to sell in a down market, an investor is likely to sell at a loss. So the real issue is, whether one can hold on to an investment through good and bad times, until the investor chooses to sell the investment at a profit. That is, why buying at the right price but also selling at the right price are so important – both determine in the end how profitable the investment was.

So, if volatility constitutes risk because it may cause a forced sale at a market low, then when using leverage that risk is significantly increased, because a significant amount of the investor`s control regarding when to sell is handed over to the lender. The latter can be demanding repayment of the loan from the investor at any inappropriate time (a down market) and thus forces the investor to sell, possiblye at a loss – a loss that is magnified by the degree of leverage used. The higher the leverage is the higher potential is for loss. To get a better idea about how much higher the risk incurred is, have a look at the figure below, where the value of $1.00 invested without leverage in the real estate market or stock market is compared to a real estate investment levered at a LTV (loan to value ratio) of 80%.

I tried to copy in the figures several times - the Editor allowed figure 1 but I can`t get figures 2 and 3 posted. If you would like to see them, please, visit my blog (http://www.canadiandiversifiedinvestor.com/). Sorry for the inconvenience.

Figure 2- Investment performance of $1 invested in real estate or shares in the Dow Jones compared with an 80% LTV real estate investment. Note equity in the leveraged investment turned negative in 1985 and a new $1 investment was made after a 7 year period of bankruptcy and credit record repair.

The increased volatility of the leveraged investment is sufficiently extreme that the non-leveraged investments seem to increase smoothly. Also, the equity invested in the 80% LTV investment was wiped out in 1985. It was assumed in this simulation, that the investor went bankrupt and needed the subsequent 7 years to repair his/her credit record and to raise new equity ($1.00) before the investor was able to re-enter the real estate market to make a new 80% LTV investment.

In Figure 3, the same investment comparisons are shown but now in terms of year-over-year investment value change and expressed as a percentage of the amount invested in the year before.

I tried to copy in the figures several times - the Editor allowed figure 1 but I can`t get figures 2 and 3 posted. If you would like to see them, please, visit my blog (http://www.canadiandiversifiedinvestor.com/). Sorry for the inconvenience.

Figure 3- comparison of investment performance of $1 invested of $1 in real estate or shares in the Dow Jones with a 80% LTV real estate investment expressed in terms of the percentage of annual change.

My conclusion is that in terms of performance, non-leveraged stock market and real estate investments are comparable in terms of risk and return over the long term. However, their performance is not well correlated because Calgary real estate outperforms the Dow Jones over certain periods while at other times the Dow Jones out performs Calgary real estate. This supports the idea of investment diversification. The use of leverage adds significant real estate investment risk and increases the potential reward (returns). This risk is often mitigated by aiming for positive cash flow obtained from rental or other real estate activities. One must however ask oneself, based on the above result, whether long term stock market investments could not be enhanced in performance as well using leverage, where the risk related to volatility is offset by funds generated from dividend income and better liquidity.