- Joined

- Oct 22, 2007

- Messages

- 1,191

Oil is starting to play the role of interest rates when it comes to determining economic growth. A lot of things are 'chicken and egg' situations. For example, if inflation increases, then interest rates tend to increase, which would increase the financing costs of government debt (amongst others). This would result in increased deficits, which politicians tend to fight not by cutting spending but by raising taxes.

Next thing you know, the increased tax rates pervades the economic prices of labour and all kinds of products. In other words it fuels inflation. Simultaneously, higher inflation fuels higher commodity prices which includes the price of oil. So it is a vicious cycle that leads to ever increasing taxes, government debt service costs, inflation and asset value increases.

People with fixed income will suffer most. Pensioners and other retirees are prime targets. They will first be forced to reduce their lifestyle especially due to the fact that the combination of inflation and high taxes will kill not only their spending power but also the real value of their nest eggs.

So just like the Bank of Canada can control, to some degree, economic growth so does the price of oil. It will force consumers to cut back their purchases and lifestyle expectations. If less product is bought, then the economy will cool and eventually slip into recession.

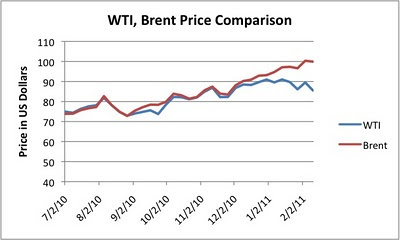

That is why the WTI Crude Oil price chart at the head of this blog is so important. It helped me make a very simple price extrapolation and predict that oil prices would likely exceed $100 per barrel in the first quarter of 2011. Apart from the Middle East unrest, we would have reached this price level anyway. The WTI prices may not be truly representative of world oil prices for now because of oil pipeline issues in the U.S. Mid West (Cushing). The Oil Drum website has an excellent review on this issue if you are interested: Why are WTI and Brent Oil Prices so Different?

Some authors such as Jeff Rubin ascribe the cause of the 2008 not only to the Subprime mortgage crises and overvalued real estate markets of Europe and the U.S. but also to the fact that the economy had no longer affordable oil to fuel the economy. A perfect storm! The bubble peak on the WTI graph in March 2008 with a WTI above $125 per barrel would seem to be the danger point.

So to forecast the oil price for the next 6 months or so (barring Middle East price shocks) suggest that oil prices should reach $105 per barrel over the next 6 months for WTI while the Brent Price may be closer to $115. By then some clouds may start to form along our economic horizon. BTW the chart below is from the aforementioned Oil Drum article.

Next thing you know, the increased tax rates pervades the economic prices of labour and all kinds of products. In other words it fuels inflation. Simultaneously, higher inflation fuels higher commodity prices which includes the price of oil. So it is a vicious cycle that leads to ever increasing taxes, government debt service costs, inflation and asset value increases.

People with fixed income will suffer most. Pensioners and other retirees are prime targets. They will first be forced to reduce their lifestyle especially due to the fact that the combination of inflation and high taxes will kill not only their spending power but also the real value of their nest eggs.

So just like the Bank of Canada can control, to some degree, economic growth so does the price of oil. It will force consumers to cut back their purchases and lifestyle expectations. If less product is bought, then the economy will cool and eventually slip into recession.

That is why the WTI Crude Oil price chart at the head of this blog is so important. It helped me make a very simple price extrapolation and predict that oil prices would likely exceed $100 per barrel in the first quarter of 2011. Apart from the Middle East unrest, we would have reached this price level anyway. The WTI prices may not be truly representative of world oil prices for now because of oil pipeline issues in the U.S. Mid West (Cushing). The Oil Drum website has an excellent review on this issue if you are interested: Why are WTI and Brent Oil Prices so Different?

Some authors such as Jeff Rubin ascribe the cause of the 2008 not only to the Subprime mortgage crises and overvalued real estate markets of Europe and the U.S. but also to the fact that the economy had no longer affordable oil to fuel the economy. A perfect storm! The bubble peak on the WTI graph in March 2008 with a WTI above $125 per barrel would seem to be the danger point.

So to forecast the oil price for the next 6 months or so (barring Middle East price shocks) suggest that oil prices should reach $105 per barrel over the next 6 months for WTI while the Brent Price may be closer to $115. By then some clouds may start to form along our economic horizon. BTW the chart below is from the aforementioned Oil Drum article.