- Joined

- Oct 22, 2007

- Messages

- 1,191

Creating an investment portfolio is like gardening – it requires constant weeding. We have to set expectations for ROI and net cash flow; we have to manage volatility or what many people call risk. Risk translates into losses only on three occasions:

1. The investment is sold

2. The investment lost all value (e.g. the share issuing company went broke).

All other risk is usually mitigated by a long term holding time (10 to 20 years) except when dealing with fixed income. Whether it is real estate or stock market investments, the typical long term return excluding leverage is 10-12% per year. So a lot depends on managing cash flow, cash and to have a portfolio volatility that fits our personal sense of risk (i.e. we`re not selling in a panic or under forced conditions). A lot of these factors depend on our personal conditions; in particular whether we are employees, business owners or people who live solely of our investments. It also depends on our investment time horizon. An 85 year old is not likely to have an investment horizon of 20 years. But this again depends on the 85 year old`s expectations and circumstances. Some 85 year olds have sufficient cash flow to allow them to have the lifestyle they want, while they have their holdings in a family trust or holding company that will remain in existence upon on their death – only the shareholders will change.

For me, I want to split my holdings into real estate, fixed income, high dividend yield stocks, and normal dividend yield stocks. Investing solely for appreciation in my books is speculation, whether you do that for real estate or stocks does not matter. When building a stock portfolio, I also want to have an active managed portion and a passive managed portion. What I mean by passive managed is that the portfolio comprises a series of ETFs (exchange traded funds) with low management fees that represent a broad segment of the market. Thus, I like a Canadian ETF that comprises mostly large cap, dividend paying companies of Canada`s stock market (the TSX 60 comes to mind as represented by Ishares – symbol XIU). You could also `enjoy` the fruits of the expanding economies of Asia by buying ETFs for Asia including or excluding Japan.

In the active managed portion, I would concentrate on major dividend paying companies, or large companies in various industry sectors. Companies such as Microsoft, Johnson and Johnson, Walgreen, GE, Canadian Natural Resources, Canadian Oil Sands, TD Bank, BMO, Royal Bank, Brookfield. And high dividend paying companies such as Riocan, CREA, Bell Alliant, Vermillion, Daylight Energy, and Superior Plus.

The dividends provide cash flow along with income from my `fixed income` section of the portfolio and from the real estate sector. During stock market crashes, bond market performance often offsets stock market performance. The same happens as we noticed with real estate. So not only do real estate and fixed income provide cash flow, they also provide protection against volatility. Fixed income would again include an active and a passive managed portion. I would also like to shelter it in RRSP or even better in TFSA accounts. Only if that provides insufficient cash flow then I would move outside the tax shelters and focus on dividend (tax advantaged) paying preferred shares. When dealing with bonds I would buy mostly passive managed bond ETFs both corporate and government. Depending on the interest outlook I would emphasize short, medium or long term bond funds. Right now, short term funds are my preference (up to 5 years). Remember that the chance of real losses increases with the term of the bonds (same for GICs). All interest paying bonds would primarily go into the TFSA and RRSP accounts. Single bonds are too expensive to buy because of the hidden commission structures that favour both full service and discount brokerages. Also, it is more difficult to diversify. The active managed portion of the fixed income portfolio would aim at buying preferred shares especially during market downturns. Preferreds issued by the big banks or companies such as yellow pages or superior plus come to mind.

The third major portfolio component is real estate. This includes your own residence (as it appreciates tax free), vacation properties (appreciates but is taxable and not likely to cash flow), other rental properties. When dealing with personal residences and vacation properties, positive cash flow is nearly impossible to achieve. But they can be the source for investment capital once paid off. A mortgage on your personal residence or recreational property is nearly as bad as a consumer loan, it is for consumption mostly. But once paid off, you could use them as security for lines-of-credit and as such they may fund true investment properties. The primary goal for investment or rental properties is to create a good ROI while having sufficient cash flow to avoid a forced sale. This means the overall ROI is a function of appreciation and mortgage principal pay down. Such investment speculates primarily on the long term appreciation of real estate and ROIs are typically around 20 to 22% per year. Do not overlook the fact that part of this return is compensation for your work which is a lot more demanding than when dealing with stock market or fixed income investing. On the other extreme are rental property investments that are not leveraged. Basically your return comprises of appreciation and the operational cash flow (Net operating income). When investing in single residential units, such cash flow as measured in terms of `cap rate` is approximately 3 to 5% of the property`s market value. Viable commercial or multifamily properties need a minimum cap rate of 5 to 8%.

Regarding the use of leverage, when investing in the stock market, there is some merit. As discussed earlier, over the long term stock market and un-leveraged real estate give similar returns. Because stock market valuations are reported on a daily or minute by minute basis, they tend to be perceived as more volatile. But if leverage is used similar to that of the real estate then in principal there is no significantly different risk. Well... So if you ensure that you borrow not more money so that interest payments do not exceed dividend income, you could play the same game. Banks and other sources of stock market capital won`t let you borrow more than 50% of your stock market account`s value – so your LTV is capped. Also, when investing in the stock market, it is considered prudent to have a certain amount of cash handy to take advantage of stock market down turns. When building up this cash position, the natural question arises, why would I have 10% cash and pay 5% interest on the money I borrow on margin? Thus it is often less practical to use leverage when dealing with paper securities than when dealing with real estate.

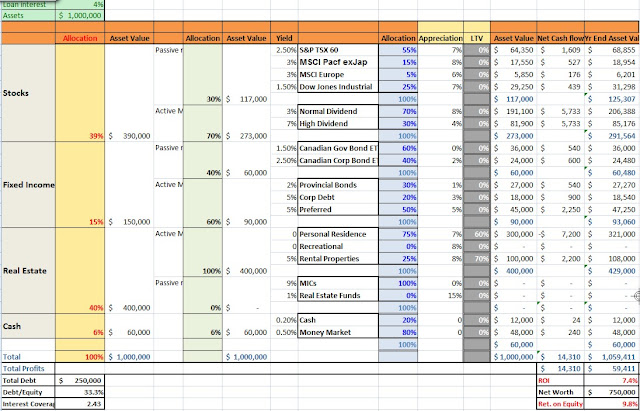

So with the above in mind, I have created a series of portfolio spreadsheets with (in my opinion) appropriate asset allocations. The allocations depend of the amount of investment assets:

1. $300,000

2. $500,000

3. $1,000,000

4. $5,000,000 (Note only one of these portfolios is posted here. The others are posted on my blog: http://www.canadiandiversifiedinvestor.com/)

If you are interested in the actual Excel Spreadsheets, just let me know and I e-mail you a copy. You can then run `what if cases` and determine what asset allocation(s) you like best.

So now that you have designed your investment garden, you only have to weed it from time to time to get/keep it in shape.

1. The investment is sold

2. The investment lost all value (e.g. the share issuing company went broke).

All other risk is usually mitigated by a long term holding time (10 to 20 years) except when dealing with fixed income. Whether it is real estate or stock market investments, the typical long term return excluding leverage is 10-12% per year. So a lot depends on managing cash flow, cash and to have a portfolio volatility that fits our personal sense of risk (i.e. we`re not selling in a panic or under forced conditions). A lot of these factors depend on our personal conditions; in particular whether we are employees, business owners or people who live solely of our investments. It also depends on our investment time horizon. An 85 year old is not likely to have an investment horizon of 20 years. But this again depends on the 85 year old`s expectations and circumstances. Some 85 year olds have sufficient cash flow to allow them to have the lifestyle they want, while they have their holdings in a family trust or holding company that will remain in existence upon on their death – only the shareholders will change.

For me, I want to split my holdings into real estate, fixed income, high dividend yield stocks, and normal dividend yield stocks. Investing solely for appreciation in my books is speculation, whether you do that for real estate or stocks does not matter. When building a stock portfolio, I also want to have an active managed portion and a passive managed portion. What I mean by passive managed is that the portfolio comprises a series of ETFs (exchange traded funds) with low management fees that represent a broad segment of the market. Thus, I like a Canadian ETF that comprises mostly large cap, dividend paying companies of Canada`s stock market (the TSX 60 comes to mind as represented by Ishares – symbol XIU). You could also `enjoy` the fruits of the expanding economies of Asia by buying ETFs for Asia including or excluding Japan.

In the active managed portion, I would concentrate on major dividend paying companies, or large companies in various industry sectors. Companies such as Microsoft, Johnson and Johnson, Walgreen, GE, Canadian Natural Resources, Canadian Oil Sands, TD Bank, BMO, Royal Bank, Brookfield. And high dividend paying companies such as Riocan, CREA, Bell Alliant, Vermillion, Daylight Energy, and Superior Plus.

The dividends provide cash flow along with income from my `fixed income` section of the portfolio and from the real estate sector. During stock market crashes, bond market performance often offsets stock market performance. The same happens as we noticed with real estate. So not only do real estate and fixed income provide cash flow, they also provide protection against volatility. Fixed income would again include an active and a passive managed portion. I would also like to shelter it in RRSP or even better in TFSA accounts. Only if that provides insufficient cash flow then I would move outside the tax shelters and focus on dividend (tax advantaged) paying preferred shares. When dealing with bonds I would buy mostly passive managed bond ETFs both corporate and government. Depending on the interest outlook I would emphasize short, medium or long term bond funds. Right now, short term funds are my preference (up to 5 years). Remember that the chance of real losses increases with the term of the bonds (same for GICs). All interest paying bonds would primarily go into the TFSA and RRSP accounts. Single bonds are too expensive to buy because of the hidden commission structures that favour both full service and discount brokerages. Also, it is more difficult to diversify. The active managed portion of the fixed income portfolio would aim at buying preferred shares especially during market downturns. Preferreds issued by the big banks or companies such as yellow pages or superior plus come to mind.

The third major portfolio component is real estate. This includes your own residence (as it appreciates tax free), vacation properties (appreciates but is taxable and not likely to cash flow), other rental properties. When dealing with personal residences and vacation properties, positive cash flow is nearly impossible to achieve. But they can be the source for investment capital once paid off. A mortgage on your personal residence or recreational property is nearly as bad as a consumer loan, it is for consumption mostly. But once paid off, you could use them as security for lines-of-credit and as such they may fund true investment properties. The primary goal for investment or rental properties is to create a good ROI while having sufficient cash flow to avoid a forced sale. This means the overall ROI is a function of appreciation and mortgage principal pay down. Such investment speculates primarily on the long term appreciation of real estate and ROIs are typically around 20 to 22% per year. Do not overlook the fact that part of this return is compensation for your work which is a lot more demanding than when dealing with stock market or fixed income investing. On the other extreme are rental property investments that are not leveraged. Basically your return comprises of appreciation and the operational cash flow (Net operating income). When investing in single residential units, such cash flow as measured in terms of `cap rate` is approximately 3 to 5% of the property`s market value. Viable commercial or multifamily properties need a minimum cap rate of 5 to 8%.

Regarding the use of leverage, when investing in the stock market, there is some merit. As discussed earlier, over the long term stock market and un-leveraged real estate give similar returns. Because stock market valuations are reported on a daily or minute by minute basis, they tend to be perceived as more volatile. But if leverage is used similar to that of the real estate then in principal there is no significantly different risk. Well... So if you ensure that you borrow not more money so that interest payments do not exceed dividend income, you could play the same game. Banks and other sources of stock market capital won`t let you borrow more than 50% of your stock market account`s value – so your LTV is capped. Also, when investing in the stock market, it is considered prudent to have a certain amount of cash handy to take advantage of stock market down turns. When building up this cash position, the natural question arises, why would I have 10% cash and pay 5% interest on the money I borrow on margin? Thus it is often less practical to use leverage when dealing with paper securities than when dealing with real estate.

So with the above in mind, I have created a series of portfolio spreadsheets with (in my opinion) appropriate asset allocations. The allocations depend of the amount of investment assets:

1. $300,000

2. $500,000

3. $1,000,000

4. $5,000,000 (Note only one of these portfolios is posted here. The others are posted on my blog: http://www.canadiandiversifiedinvestor.com/)

If you are interested in the actual Excel Spreadsheets, just let me know and I e-mail you a copy. You can then run `what if cases` and determine what asset allocation(s) you like best.

So now that you have designed your investment garden, you only have to weed it from time to time to get/keep it in shape.