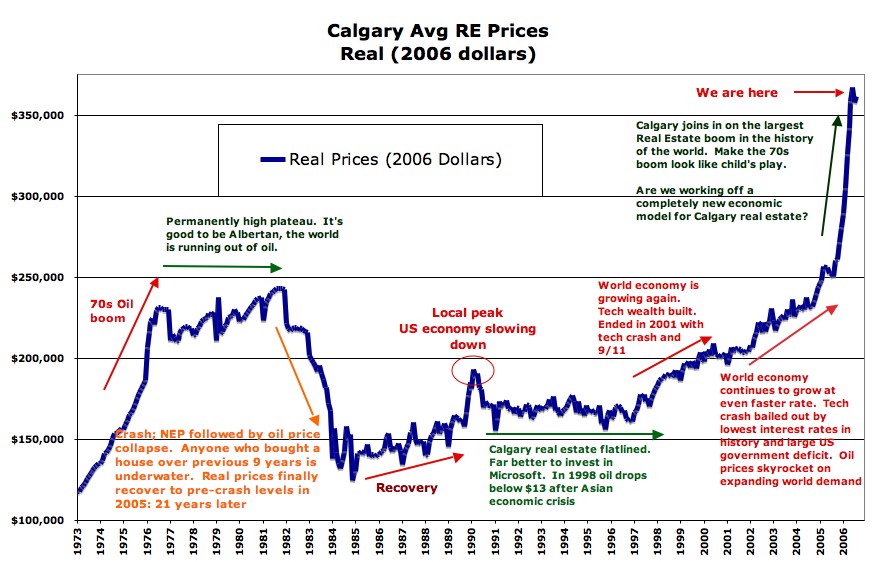

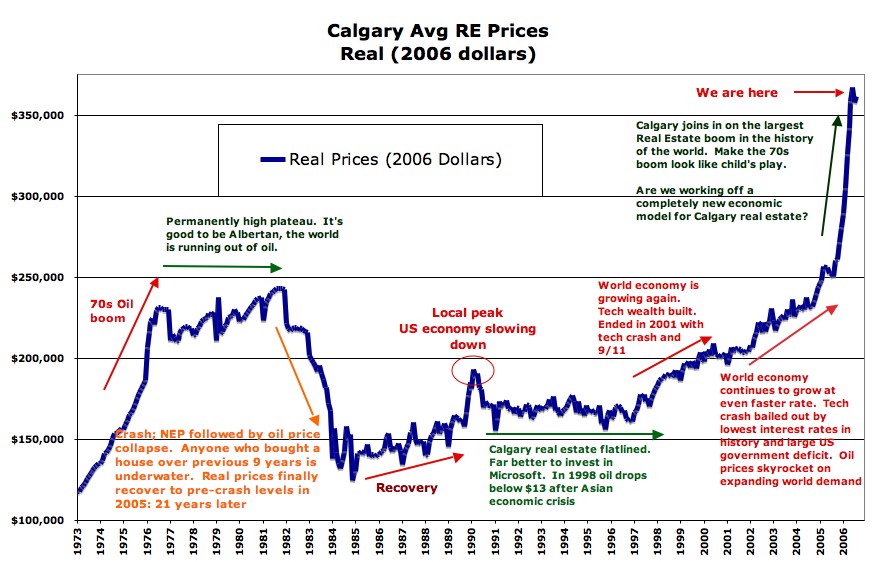

Contrarian`s View on Calgary & Edmonton Real EstateI am a professional real estate investor and since several months ago I no longer hold any Alberta real estate in my portfolio. Alberta has been real estate investors` dream come true in the past few years however I do not believe real estate prices will continue to increase substantially and I believe there is a very significant risk that prices may dramatically fall. Real estate prices have doubled in the past few years however wages have increased only 15% in the past 5 years. I question whether this growth of real estate prices is sustainable for the next few years. The chart below makes me wonder whether part of the growth was related to a real estate bubble (another topic for another day).

http://tinyurl.com/yku9aq

Affordability Level

The affordability levels in Calgary and Edmonton has reached approximately 45% of pretax income well above the 33% guideline recommend by Don Campbell.

Here is a quote from his Real Estate Investing in Canada book "Even though prices may be skyrocketing, if the city`s index is 5 percent or more above this mark, it is an indicator that the market is turning speculative and the fundamentals are getting out of balance". I question why Edmonton is still promoted by REIN when it`s index is more than 10% above the guideline.

It is becoming quite expensive to own a home in Alberta and less affordable. Edmonton and Calgary are not world class cities like Vancouver, Toronto or New York to maintain high un-affordability levels.

Real Wages Are Decreasing in Alberta

Yes Albertans have had wage increases but due to high inflation and housing prices the average Albertan earns less salary when adjusted to inflation than five years ago. How will the end users of homes be able to buy homes with higher house prices if they have less purchasing power than they did beforehttp://tinyurl.com/2mf2ss

Why should people move to Alberta now when they will earn less purchasing power than five years ago? People will realize that it`s not as great as it is promoted. Heck from what I read the net migration of people to Alberta is decreasing since there are more people leaving than before in past few years.

35% of Edmonton`s Inventory is Vacant

This is not a healthy sign and this indicates that a lot of properties are held by speculators and real estate investors. (http://tinyurl.com/ysdu89 ) I have become concerned that a lot of the demand in Edmonton and Calgary has been driven by investors and may have artificially pushed prices higher than they would have been. Every single real estate investor I know has been investing in Alberta and they all unquestionably believe it can only go up. Maybe they are right and it will continue to amaze everyone. I just know that you make more money when you move against the masses.

Record High Inventory

Calgary and Edmonton both are near record high levels of real estate inventory. There is massive supply and sales have been decreasing. Supply and demand dictates that prices should decrease. From talking to real estate investors everyone tells me that everything will turn around in Spring and inventory will go back to normal. There is a chance supply might increase because every seller I know who could not sell in the last few months has de-listed from MLS and is waiting for Spring to re-list. I would not be surprised if we have a massive number of inventory as sellers are all hoping for a spring rebound.

Real Estate Prices Decrease $50,000 (10%) in 4 Months

The average price of a Single Family Home in Calgary was $505,920 in July 2007 and it was $452,254 in October 2007. The median price of a SFH also decreased $40,000.->http://tinyurl.com/3d6xcn

Hopefully, this is just a small correction but the last time I have seen a $50,000 correction was Alberta real estate crash in the last oil boom.

Conclusion

I have a feeling I will be labeled as doom and gloom guy but it`s the way I see things. Yes, I know that Alberta has massive oil reserves however I believe that fact has already been priced into housing prices.

I love real estate and I believe it can be a great investment. However, I believe there may be less risky places to invest in than Edmonton and Calgary. I cannot see how continued price increases in Edmonton and Calgary can be sustained.

http://tinyurl.com/yku9aq

Affordability Level

The affordability levels in Calgary and Edmonton has reached approximately 45% of pretax income well above the 33% guideline recommend by Don Campbell.

Here is a quote from his Real Estate Investing in Canada book "Even though prices may be skyrocketing, if the city`s index is 5 percent or more above this mark, it is an indicator that the market is turning speculative and the fundamentals are getting out of balance". I question why Edmonton is still promoted by REIN when it`s index is more than 10% above the guideline.

It is becoming quite expensive to own a home in Alberta and less affordable. Edmonton and Calgary are not world class cities like Vancouver, Toronto or New York to maintain high un-affordability levels.

Real Wages Are Decreasing in Alberta

Yes Albertans have had wage increases but due to high inflation and housing prices the average Albertan earns less salary when adjusted to inflation than five years ago. How will the end users of homes be able to buy homes with higher house prices if they have less purchasing power than they did beforehttp://tinyurl.com/2mf2ss

Why should people move to Alberta now when they will earn less purchasing power than five years ago? People will realize that it`s not as great as it is promoted. Heck from what I read the net migration of people to Alberta is decreasing since there are more people leaving than before in past few years.

35% of Edmonton`s Inventory is Vacant

This is not a healthy sign and this indicates that a lot of properties are held by speculators and real estate investors. (http://tinyurl.com/ysdu89 ) I have become concerned that a lot of the demand in Edmonton and Calgary has been driven by investors and may have artificially pushed prices higher than they would have been. Every single real estate investor I know has been investing in Alberta and they all unquestionably believe it can only go up. Maybe they are right and it will continue to amaze everyone. I just know that you make more money when you move against the masses.

Record High Inventory

Calgary and Edmonton both are near record high levels of real estate inventory. There is massive supply and sales have been decreasing. Supply and demand dictates that prices should decrease. From talking to real estate investors everyone tells me that everything will turn around in Spring and inventory will go back to normal. There is a chance supply might increase because every seller I know who could not sell in the last few months has de-listed from MLS and is waiting for Spring to re-list. I would not be surprised if we have a massive number of inventory as sellers are all hoping for a spring rebound.

Real Estate Prices Decrease $50,000 (10%) in 4 Months

The average price of a Single Family Home in Calgary was $505,920 in July 2007 and it was $452,254 in October 2007. The median price of a SFH also decreased $40,000.->http://tinyurl.com/3d6xcn

Hopefully, this is just a small correction but the last time I have seen a $50,000 correction was Alberta real estate crash in the last oil boom.

Conclusion

I have a feeling I will be labeled as doom and gloom guy but it`s the way I see things. Yes, I know that Alberta has massive oil reserves however I believe that fact has already been priced into housing prices.

I love real estate and I believe it can be a great investment. However, I believe there may be less risky places to invest in than Edmonton and Calgary. I cannot see how continued price increases in Edmonton and Calgary can be sustained.