- Joined

- Dec 4, 2007

- Messages

- 261

Latest Acquisition Update

December 1, 2013

Slow but sure

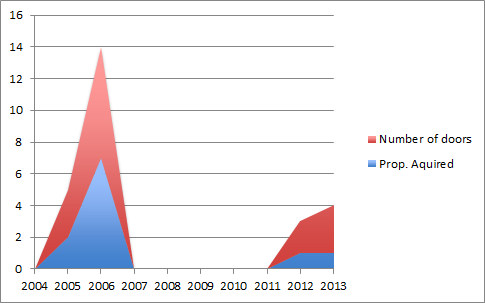

From 10 doors in the span of 1 year around 2005 to 2006, since the downturn of late 2007 early 2008, things have slowed down dramatically for us in the acquisition phase. So far it`s been one property per year (adding 5 more doors) in the past 2 years depending on how much capital raised. We are pacing slow but sure indeed!

What Works Today

Single unit properties no longer make the cut in the cash-flow zone unless we are willing to cough out hundreds of dollars out of pocket each month. To be able to grow a healthy and sustainable real estate portfolio, this is not the way to run the business. On the other hand, a building with 2 or more doors will surely look a lot better in the real estate playing field. For instance, in an up and down non conforming duplex scenario today, it can cost you around the $340,000 mark. This offsets today`s high rental income due to increasing demand from a non stop migration of workers in Alberta. Not including utilities, an upper floor unit can provide $1200 to $1800 depending on how many rooms, and $900 to $1000 for the lower or basement suite. This averages about $2450 of rental income each month. After all expenses, debt service and any rainy day replenishing fund set aside, there is plenty of net cash flow to go around.

Our Most Recent Purchase

Around the summer time, a beautiful corner lot by-level property was available on the market. After running the numbers, I dispatched it right away to my acquisition team for an immediate viewing. It is a large house with about 1700 square foot of living space in the main floor. The basement has two apartments with separate entrances, big egressing windows, and 2 bedrooms each. It is a wonderful setup. Based on the property inspection, there were some electrical and plumbing work needed to be done to keep the property up to code. Overall, the house was in good shape with just some small renovations to accommodate an even better setup for each of the units.

We wrote an offer $15,000 below asking price with a cover letter explaining where we stood. Conditions of sale were subject to financing and property inspection to be lifted after 10 days upon offer acceptance. We went back and forth with price negotiation. Based on the inspection uncovering more plumbing and electrical issues in the basement suites, our offer was accepted.

We worked with our banker for the financing of the 80% of the property. Four days left before our condition was lifted, we ran into an issue regarding a change of policy from the lender's side. We`re informed that my money partner needed to be in the mortgage and on title to be qualified. We got all requirements in place and got the financing approval on the last day our condition was due.

Here's What You Are Waiting For...

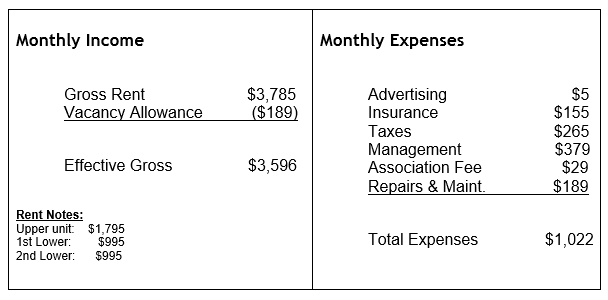

With this 3 unit complex, here`s how it looks in numbers:

NOI (Net Operating Income): $2,574

Debt Service: ($1,737)

Monthly Cash Return: $837

Cashflow Zone @ 9.36%

I you are having problem displaying the graph and table for the numbers...please view the full article by clicking here! (Via Google Drive) Thank you!

December 1, 2013

Slow but sure

From 10 doors in the span of 1 year around 2005 to 2006, since the downturn of late 2007 early 2008, things have slowed down dramatically for us in the acquisition phase. So far it`s been one property per year (adding 5 more doors) in the past 2 years depending on how much capital raised. We are pacing slow but sure indeed!

What Works Today

Single unit properties no longer make the cut in the cash-flow zone unless we are willing to cough out hundreds of dollars out of pocket each month. To be able to grow a healthy and sustainable real estate portfolio, this is not the way to run the business. On the other hand, a building with 2 or more doors will surely look a lot better in the real estate playing field. For instance, in an up and down non conforming duplex scenario today, it can cost you around the $340,000 mark. This offsets today`s high rental income due to increasing demand from a non stop migration of workers in Alberta. Not including utilities, an upper floor unit can provide $1200 to $1800 depending on how many rooms, and $900 to $1000 for the lower or basement suite. This averages about $2450 of rental income each month. After all expenses, debt service and any rainy day replenishing fund set aside, there is plenty of net cash flow to go around.

Our Most Recent Purchase

Around the summer time, a beautiful corner lot by-level property was available on the market. After running the numbers, I dispatched it right away to my acquisition team for an immediate viewing. It is a large house with about 1700 square foot of living space in the main floor. The basement has two apartments with separate entrances, big egressing windows, and 2 bedrooms each. It is a wonderful setup. Based on the property inspection, there were some electrical and plumbing work needed to be done to keep the property up to code. Overall, the house was in good shape with just some small renovations to accommodate an even better setup for each of the units.

We wrote an offer $15,000 below asking price with a cover letter explaining where we stood. Conditions of sale were subject to financing and property inspection to be lifted after 10 days upon offer acceptance. We went back and forth with price negotiation. Based on the inspection uncovering more plumbing and electrical issues in the basement suites, our offer was accepted.

We worked with our banker for the financing of the 80% of the property. Four days left before our condition was lifted, we ran into an issue regarding a change of policy from the lender's side. We`re informed that my money partner needed to be in the mortgage and on title to be qualified. We got all requirements in place and got the financing approval on the last day our condition was due.

Here's What You Are Waiting For...

With this 3 unit complex, here`s how it looks in numbers:

NOI (Net Operating Income): $2,574

Debt Service: ($1,737)

Monthly Cash Return: $837

Cashflow Zone @ 9.36%

I you are having problem displaying the graph and table for the numbers...please view the full article by clicking here! (Via Google Drive) Thank you!