QUOTE (bizaro86 @ Nov 10 2010, 08:10 AM) I suspect the vast majority of people who buy real estate as an investment are no longer involved with real estate as an investment after 5 years. They discover that there is no free money in life, no matter what the .......

new real estate investor`s are typically not required to get a business license, unlike owners of a new flower shop. REIN might have something, although I suspect new real estate investors with some REIN experience (ACRE, etc) are probably significantly more successfull than average.

Regards,

Michael

As pointed out numerous times. Real Estate should be just one component of an investment portfolio. In fact I dare to go so far as wondering whether REIN`s approach represents investment or whether it is more appropropriate to see it as an career in real estate.

We have had numerous discussions on this forum about ROI and the source of profits. The conclusion was that a significant proportion of real estate proceeds is from work: selecting suitable properties, raising capital; selecting and managing (directly or indirect) rental properties.

Truly investing is to have money work for you; but most REIN members work for money. This is not to say that the REIN method is wrong, I think it is mislabeled tough. Think about it? For many of us, having rental properties requires a lot of work some even consider making a full time career switch into real estate. Anyone thinks that Thomas Beyer is retired living of his money? Maybe when he bought his first rental pool property; then though he rapidly expanded into multifamily properties; set up Prestigous Properties; all kinds of limited partnerships and runs now 1200 doors. Wow, some form of retirement!

No Thomas is a real estate entrepreneur and he is very good at it. Don Campbell is a real estate entrepreneur and so is Brett Turner and Dominic Mandato and many others. Every workshop we are reminded that we should run our real estate as a business. That is dead on! We are not passive investors most of us are entrepreneurs whether it is large or small.

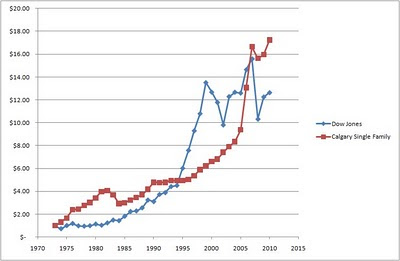

As to whether Real Estate is a save investment rather than a profitable career, that remains to be seen. One thing that caught my eye in this regard is the graph below:

http://3.bp.blogspot.com/_nYzKeglaLNU/S_gf...+leveraged..jpg

This is 1 dollar invested in the Dow Jones versus 1 dollar invested in a Calgary Single Family Property starting in 1973 until 2010. Do you see the difference? Neither do I.

What I do see is that real estate and stock market are good asset classes to own in a diversified investment portfolio. There are times that real estate outperforms and other times that the stock market outperforms. They are poorly correlated in performance (over the short term) over the long term (50 yrs) the seem to provide a similar rate of return. That is the dream of every asset allocator!

Oh... but in real estate we use leverage. Well guess what, in the stock market you can borrow on margin. Yes these investments have different attributes, but in the end there is a value for money that is invested and overtime that value will be determined by the markets. If overtime one investment type is better performing than the other everyone would invest in the first until the other starts to outperform.

Real Estate and Stock Markets in my view offer similar returns because they have a similar risk profile or better a similar profile in price volatility, while others such as GICs or government debt have less volatility and that is expressed in its ROI over the long term.

By the way, I would not dismiss the above as somekind of idiosyncrasy! Think about it! To call yourself a real estate entrepreneur justifies why you can ask for 50% of the profits while the JV investor puts down the financing (down payment and qualifies for the mortgage). You work for compensation using your expertise while for the JV investor his money works!