Canadians Who Own U.S Real Estate: Staying on the Right Side of the IRS and the CRA

By Peter Cuttini, CA, CPA

Canadians have a variety of potential ownership structures when purchasing U.S. real estate, as Greg Coleman of the US Property Shop outlined in last month’s Behind the Curtain. However, each of these ownership structures has different tax implications and filing requirements to ensure that you stay on the right side of the IRS and the CRA.

Personal ownership

If you are a Canadian resident who owns a property personally in the U.S. and derive income from the property, you must file a

1040 NR U.S. Non-resident Alien Income Tax Return. The normal due date for the return is April 15th, but Canadians can get an automatic extension to file the tax return to June 15th. However, any tax owing will still be due April 15th. The government wants the money first, and then accepts the paperwork after the fact.

When owning properties personally in the U.S., the following is a list of common tax implications to be aware of:

- In most circumstances, taxpayers elect to treat the income from the rental property as effectively connected income to the United States. This will tax the rental income on a net basis at the U.S graduated tax rates. If you do not make this election, the tax will be 30% of the gross rent. To make this election, the owner must provide a W8-ECI to the property manager or renter. If not provided, the property manager or renter must withhold 30% of the gross rent to the IRS on a monthly basis.

- Unlike Canada, annual depreciation of the property and all other capital assets is mandatory. Depreciation is calculated using the Modified Accelerated Cost Recovery System (MACRS).

- If the property was also used for personal use, the expenses will be limited to only the percentage of time the property was rented.

- In most cases, real estate rentals are considered passive investments. If the property is operating at a net loss for U.S. tax purposes, the loss will be carried forward to a future year to be applied against future income.

- You must have a U.S. Tax Identification Number (“ITIN”) for the tax return. If you do not have an ITIN, you can apply for one with the tax return. To receive the ITIN, you complete a form W7 Application for IRS Individual Taxpayer Identification Number form.

- If the property is jointly owned, each spouse or owner must file their own U.S. tax returns.

- The rental income and all related expenses are reported on Schedule E of the tax return.

- You may also need to file a state income tax return. (Some U.S. states do not have personal income tax.)

- If you sold the property during the year, you must report any capital gains or losses on Schedule D. Long-term capital gains (property owned more than one year) are taxed federally at a maximum of 15% of the capital gain. Any previously taken depreciation is added to income as a Section 1250 gain. These Section 1250 gains are subject to a higher maximum federal capital gains rate of 25%.

- You must report the income from the property on your Canadian personal tax return, as well. Don’t forget to claim a foreign tax credit for any U.S. federal and/or state income taxes paid.

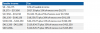

2016 U.S. individual tax rate for non-resident taxpayers

Corporate ownership

Corporate ownership

If the property is owned by a corporation, the corporation must file either:

- an 1120 U.S. Corporation Income Tax Return, if the property is owned by a U.S. C Corporation

- an 1120F U.S. Income Tax of a Foreign Corporation, if the property is owned by a Canadian Corporation

Both tax returns are due on the 15th of the third month following the year-end of the corporation. You can file an extension to file the tax returns later for each return, but unlike personal income tax returns, the extensions are not automatic. To get an extension to file the tax return, 90% of the final taxes owing must be paid with extension. This normally means that the taxpayer submits a larger than anticipated payment with the extension. The extension to file the tax return is request by submitting Form 7004 by the original due date of the tax return.

The corporation reports all of its income and expenses on the tax return. The corporation is taxed at U.S. corporate rates on any net income generated from the property. Capital gains generated from selling a property is reported on Schedule D. The maximum U.S. Federal corporate capital gains rate is 35%.

If the U.S. Corporation is owned by a Canadian taxpayer, whether a Canadian corporation or individual, the taxpayer must include the required forms with the tax return disclosing this foreign ownership.

The corporation must also file any applicable state and local tax returns, as required.

A Canadian owner of a U.S. C Corporation does not have to report any income from the C Corporation in Canada until that income is repatriated to Canada.

2016 U.S. corporate tax rates for non-resident taxpayers

Limited Liability Partnership

Limited Liability Partnership

Over the past few years, we have seen an increase in U.S. property being purchased by Canadians using a Limited Liability Partnership (LLP) structure. The LLP structure can be used to minimize legal liability risks, while allowing preferential tax treatment of a flow through entity to the individual partners. The partnership must file a

1065 U.S. Return of Partnership Income to report the income and expenses of the property. The 1065 return is an information return and hence the partnership does not pay taxes. The income flows through to each partner of the partnership, based on their percentage ownership of the partnership. The 1065 return is due the 15th of the fourth month after the year-end of the partnership.

Each partner will receive a K-1 from the partnership, which will indicate the partner’s proportional share of any income or loss from the partnership. Each partner will then have to report this income on their U.S. tax return. If the partner is a Canadian individual, the income will be reported on a

1040NR U.S. Nonresident Alien Income Tax Return as discussed above.

There may also be a state and local tax return required.

Tax implications of the three U.S. structures

How does all this play out in the amount of taxes you owe in the U.S. and Canada?

Assumptions

- Taxpayer in Ontario at top bracket (assume 50% tax bracket)

- Property in the state of Florida

- US corporation declares dividend to Canadian shareholder each year

As you can see, U.S. tax returns can be complicated. We suggest that you consult with an experienced cross-border accountant to assist in completing the tax returns.

Peter Cuttini, CA, CPA, whose practice with his partner George Dube, Dube & Cuttini Chartered Accountants LLP, focuses on providing the knowledge and tools clients from across the country, and around the world need, to increase and preserve the value of their businesses. Peter is a CA and CPA, and a real estate investor, who brings over 20 years of accounting, managing and business experience to the firm’s clients. As a CPA, Peter provides clients with advice on all matters related to US tax, in addition to the business advisory and compliance services he provides on Canadian business matters. Peter has written various articles on US tax matters for national publications and is a member of the REIN faculty.

@PeterCuttini

[email protected]